VOA标准英语10月-Bush Remains Confident About Financial Rescue Pla(在线收听)

|

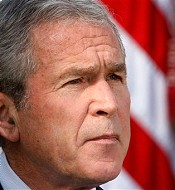

| President George W. Bush makes statement on the economy at the White House, 10 Oct 2008 |

President Bush says the U.S. financial rescue plan will, in time, put the nation's economy back on its feet.

"The plan we are executing is aggressive,' the president explained. "It is the right plan. It will take time to have its full impact. It is flexible enough to adapt as the situation changes, and it is big enough to work."

The president spoke outside the White House Friday, hoping to calm anxiety among Americans and people around the world about the state of the U.S. and global economy.

"This uncertainty has led to anxiety among our people. And that is understandable. But anxiety can feed anxiety," Mr. Bush noted. "And that can make it hard to see all that is being done to solve the problem. The federal government has a comprehensive strategy and the tools necessary to address the challenges in our economy."

Meanwhile, leaders of the world's leading economies are meeting to look for answers to the global crisis. Finance ministers and central bankers from the Group of Seven--the United States, Japan, Britain, Germany, France, Italy and Canada - are in Washington for the weekend. Mr. Bush plans to meet with them on Saturday.

"Through these efforts the world is sending an unmistakable signal. We are in this together and we will come through this together," he said.

One possible remedy that may be discussed at the G-7 meeting is for governments to guarantee lending between banks.

Frozen credit markets and the prospect of a global recession have led to panic selling on the world's stock markets.

Asian and European stocks suffered major losses on Friday. Tokyo's Nikkei Index dropped 881 points, more than 9.5 percent, finishing Friday at 8,276. It was the biggest one-day loss for the Nikkei since 1987. It was a similar story in Hong Kong, where the Hang Seng plunged 7 percent, or 1146 points, closing at 14,797.

Stocks in London, Paris and Frankfurt were also down sharply for much of the day.

Heavy selling led exchanges in Austria, Russia and Indonesia to suspend trading, and the losses on Australia's markets caused traders to call it "Black Friday." Mr. Bush discussed the financial meltdown with Australian Prime Minister Kevin Rudd on Friday.

In New York, the Dow Jones Industrial Average dropped more than 600 points in the first few minutes of trading, then briefly surged into positive territory a half-hour later, but plunged again.

This week's coordinated interest rate cuts by several nations' central banks appear to have had little or no effect on investors' confidence.

In other financial news, the Commerce Department says the U.S. trade deficit declined by 3.5 percent in August, to $59 billion. But the deficit with China rose to more than $25 billion, the second highest on record. The overall trade deficit is expected to continue shrinking, as the economic slump leads to lower demand for imported goods.

One of America's biggest companies, General Electric, announced that its third-quarter profit was down by 22 percent. G.E. blamed the losses on its financing business.

And Citigroup is suspending its bid to buy the troubled bank, Wachovia. That paves the way for Wachovia to be acquired by Wells Fargo.