voa标准英语2008年-US Government Acts to Spur Lending Amid Economi

搜索关注在线英语听力室公众号:tingroom,领取免费英语资料大礼包。

(单词翻译)

The U.S. economy has contracted more sharply than previously1 believed, according to new government figures. Meanwhile, in yet another sign of continuing stress in the credit market, the U.S. central bank is allocating2 hundreds of billion of additional dollars to purchase bad mortgage debt and spur consumer lending. From Washington, VOA's Michael Bowman reports. |

| A mother and daughter shop for a Barbie at a Toys R Us store, in New York, 21 Nov 2008 |

Revised figures from the Commerce Department show the American economy shrank at an annual rate of 0.5 percent in the third quarter of the year, a greater contraction3 than the original estimate of 0.3 percent. The negative quarter followed a year of mostly-anemic growth, and, while the fourth quarter has yet to be completed, economists5 believe it, too, will show significant contraction.

"GDP [gross domestic product] fell by 0.5 percent because consumers spent less, there were fewer new homes built, and expenditures6 for business purposes fell," said. University of Maryland economist4 Peter Morici. "Unfortunately, this is a precursor7 of worse things to come."

Most analysts8 trace America's current economic woes9 to tight credit conditions sparked by a wave of home foreclosures and mortgage defaults. In recent weeks, the U.S. government has taken a series of aggressive, unprecedented10 steps to prop11 up or take control of major lending institutions and financial firms, committing well over $2 trillion to the effort.

Now, the Federal Reserve says it will devote an additional $600 billion to combat the mortgage meltdown, and another $200 billion to unfreeze consumer credit. A small portion of the new funds will come from a $700 billion rescue package Congress approved last month, which is being administered by the Treasury12 Department.

|

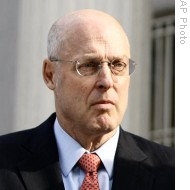

| Treasury Secretary Henry Paulson outside the Treasury Department in Washington, 24 Nov 2008 |

"By providing liquidity13 to issuers of consumer asset-backed paper [consumer loans], the Federal Reserve facility will enable a broad range of institutions to step up their lending, enabling borrowers to have access to lower-cost consumer finance and small business loans," said Treasury Secretary Henry Paulson. "Today's announcement by the Fed underscores our support for the housing market. Nothing is more important to getting through this housing correction than the availability of affordable14 mortgage finance."

Few, if any economists would contest the importance of the availability of credit to the health of the American economy, nor the desirability of the federal government doing all it can to reverse a credit crunch15 that has constrained16 businesses and consumers alike.

But the sheer scale of initiatives undertaken to date, and the apparent need for successive waves of government intervention17 are an unsettling indication of the magnitude and the tenacity18 of the problem being confronted, according to economics professor Lawrence White of the University of Missouri.

"It is a recognition [that] we still have a big problem. It is a strong statement by the Fed that it is going to take massive, broad, forceful efforts to try to break the back of [resolve] the crisis," he said.

In the face of relentlessly19 grim economic news, Treasury Secretary Paulson says the federal government is doing all it can to mitigate20 the situation.

"It will take time to work through the difficulties in our market and our economy, and new challenges will continue to arise. I and my regulatory colleagues are committed to using all the tools at our disposal to preserve the strength of our financial institutions and stabilize21 our financial markets to minimize the spill-over [damage] into the rest of the economy," he said.

In other economic news, a private research firm says U.S. consumer confidence has rebounded22 somewhat this month, aided by falling energy prices, but that the index remains23 at a low level. Meanwhile, U.S. export growth slowed, while American homebuilders continue to cut spending.