VOA标准英语10月-US Central Bank Chief Gives Gloomy Economic Asses(在线收听)

|

| Fed Chairman Ben Bernanke, seen on a television screen on the New York Stock Exchange trading floor, 7 Oct. 2008 |

Chairman Bernanke says severe upheaval in America's financial sector has further strained an already weak U.S. economy. Addressing a business association in Washington, the Fed chief gave a gloomy assessment of economic prospects.

"The housing market continues to be a primary source of weakness in the real economy as well as the financial markets," he said. "However the slowdown in economic activity has spread outside the housing sector. Private payrolls have continued to contract, and the declines in employment, together with earlier increases in food and energy prices, have eroded the purchasing power of households. Overall, the outlook for economic growth has worsened."

Bernanke did not say the United States has entered a recession or predict that a recession is looming. Rather he said that inflation worries have moderated somewhat and that "the downside risk to growth has increased."

"In light of these developments, the Federal Reserve will need to consider whether the current stance on policy remains appropriate," he said.

The "current stance on policy" is widely viewed by economists and Fed-watchers as current U.S. interest rates - an indication that the Fed will at least consider further cuts to stimulate economic growth and promote lending.

Earlier in the day, the Federal Reserve unveiled an aggressive plan to make it easier for American companies to finance short-term needs like payroll obligations and purchasing supplies.

The initiative follows another major government effort to end a credit crunch that could further stifle economic growth. Last week, President Bush signed into law a massive financial rescue package that empowers the federal government to buy bad debt from struggling U.S. financial institutions.

|

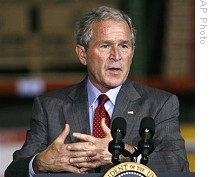

| President Bush speaks about the economy during a visit to Guernsey Office Products Inc., an office products firm in Chantilly, Virginia, 7 Oct. 2008 |

Speaking outside Washington, Mr. Bush urged patience when it comes to addressing America's financial ills.

"Thawing the freeze in the financial system is not going to happen overnight," he said. "It will be a process that unfolds over several stages, and obviously the first stage began last Friday when I signed the rescue package into law. And so the Treasury Department is moving aggressively to implement the new authorities."

The president said the United States will coordinate its efforts to contain the financial crisis with those of other major industrialized nations, noting an upcoming meeting of G-7 finance ministers later this week in Washington.

Meanwhile, world markets were mixed. One day after sinking to its lowest level in four years, Wall Street's Dow Jones Industrial Average opened higher before retreating to triple-digit losses in afternoon trading. Major European markets were mixed, with London and Paris recording slight gains while shares in Frankfort closed moderately lower.

Earlier, Tokyo's market finished with a three-percent loss.